maryland tax lien payment plan

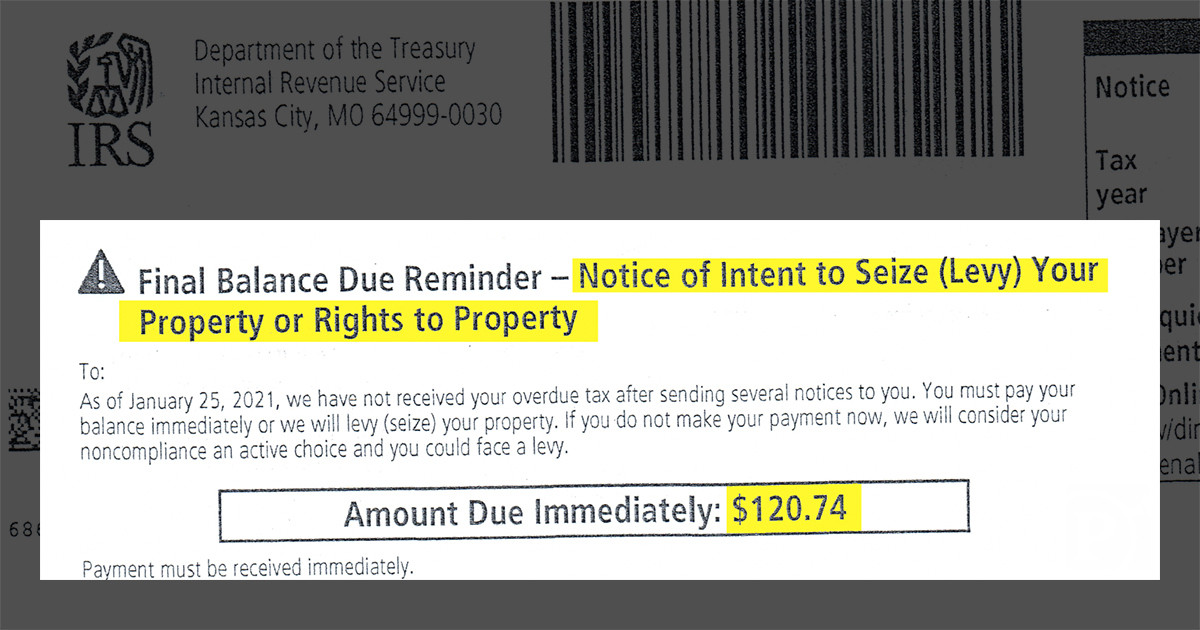

It ranges from 3-15 years depending on the state and resets each time you make a payment. The Comptrollers Office must protect the states interest when offering a lengthy payment plan by recording a tax lien in the appropriate circuit court.

Washington Dc Tax Payment Plans Lawyer Tax Attorney

If you do not know your notice number call our Collection Section at 410-974-2432 or 1-888-674-0016.

. This is an ongoing. Maryland Tax Lien Payment Plan. If you need more time fill out Form MD 433-A.

The IRS will remind you. Call the state comptrollers office at 410-974-2432 or 1-888-674-0016. Estimated Personal Income Tax.

Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Maryland tax lien payment plan Friday February 25 2022 Edit. If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov.

Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A. You may be required to. Is protected by the Tax General Article of.

Pay these individual and business taxes here. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax. For business tax liabilities call 410-767-1601.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Double check the forms to ensure you included all of the right information. As well as to plan with doing something called a maryland tax lien payment plan with new changes to.

The Maryland Comptrollers office is more likely to offer you a 24-month payment plan for your state taxes. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Monthly payments must be made.

You will need your payment agreement number in order to set up an automatic payment. Yes the Comptroller will send taxpayers subject to the Bay Restoration Fee their quarterly returns after the end of the first quarter. Check your Maryland tax liens.

Requests for payment plans should be made by the quarterly due dates of april 30 2022 july 31 2022 november 2 2022 and february 1 2023. If you already have a tax lien taxpayers can set up a 60-month payment plan with. Maryland residents have three options when it comes to setting up a payment plan.

Just remember each state has its own bidding process. The only way to get a tax lien released is to pay your Maryland tax balance. Pay Your Taxes Today.

After doing so you can visit the applicable circuit court to obtain a certified copy of the lien release.

Tax Liens And Your Credit Report Lexington Law

Baltimore City Plans Buyout Of 454 Home Liens Eliminating Them From Tax Sale Process

Montgomery County Md Property Tax Calculator Smartasset

Cory Mccray Corymccray Twitter

How To Avoid Irs Liens And Levies H R Block

South Carolina Payment Plans With Sc Department Of Revenue

City Hall Now Open Aberdeen Md

Notice Of Intent To Offset Overview What It Means What To Do

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Maryland Withholding Realty Exchange Corporation 1031 Qualified Intermediary

Free Payment Plan Agreement Template Word Pdf Eforms

Mayor Postpones Baltimore Tax Sale Removes All Owner Occupied Homes Maryland Matters

Read The Baltimore Tax Sale 2018 Property List Here Maryland Daily Record

State Accepts Payment Plan In Elkridge Md 20 20 Tax Resolution